Via Scoop.it – Demand Transformation

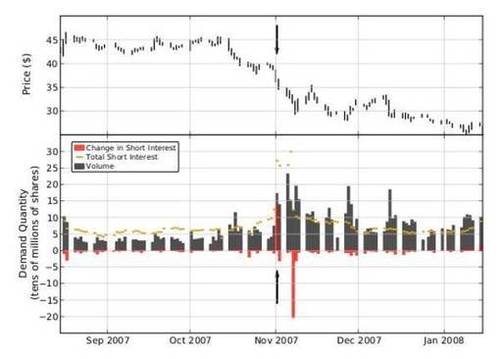

A paper from the New England Complex Systems Institute claims that they have found evidence that traders executed a “bear raid” on Citigroup in 2007, precipitating the financial collapse. “Bear raids” have been considered a risk to markets since the Great Depression, and a financial regulation called the “uptick rule” was instituted in 1938 to prevent the tactic. The uptick rule was repealed in in July, 2007, and the alleged bear raid took place in November, 2007.

Via boingboing.net

Complex Systems Institute claims “bear raid” market manipulation crashed the global economy – Boing Boing

More from Demand TransformationMore posts in Demand Transformation »

- First they came for the Whistleblowers, and I did not speak out

- Message to My Senator Boxer: Uphold your Oath of Office: Squash Shadow Secret Gov’t

- Data Wants to be Free (as in Freedom)

- Self-Driving Cars: Biggest Societal Change Since… Cars

- Gigabit Internet for $70: the unlikely success of California’s Sonic.net WHY NOWHERE ELSE? Hint: Oligopoly